Patient Protection and Affordable Care Act (PPACA), commonly known as Obamacare or the Affordable Care Act (ACA) is health care reform legislation. It consists of the Patient Protection Act, the Affordable Health Care for America Act, the Student Aid and Fiscal Responsibility Act and parts of the Health Care and Education Reconciliation Act, as well as amendments made to existing laws and regulations.

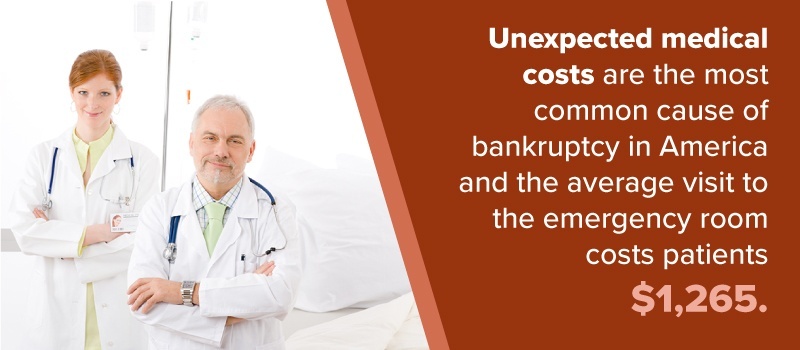

The legislation was introduced in part due to concerns about rising health care costs. Unexpected medical costs are the most common cause of bankruptcy in America. The average visit to the emergency room costs patients $1,265. In addition, before the ACA, some Americans had trouble qualifying for health coverage because of their age or medical history. Investigative reports uncovered instances of abuse in the healthcare and insurance systems.

The ACA is a wide-reaching reform law designed to address some of these issues. The legislation attempts to reign in healthcare spending while offering more widespread and affordable healthcare coverage for a greater number of Americans. The legislation also works to add benefits.

Under the ACA, all Americans are required to get insurance and will be eligible to get coverage, even if they have pre-existing health conditions. This will mean more people will not have to worry about being uninsured. In 2013, for example, 15% of Americans did not have health coverage while 95% of Americans after the ACA are insured. Americans can search for health coverage through employers, an online marketplace, brokers or insurance companies.

Once Americans and families have coverage, they can't be dropped or denied coverage because they have a serious illness. Insurance companies also have to get state approval before raising premiums, and can't spend more than 20% on executive salaries, advertising or other costs not related to providing medical care. These and other changes were introduced to address some of the concerns legislators had about abuses in the health insurance industry.

In addition, insurance coverage under the ACA is required to offer specific benefits, including:

- Newborn and maternity care

- Preventative care, wellness visits and care related to the management of chronic conditions

- Devices and care for people with disabilities, chronic conditions and injuries

- Health treatment related to behavioral and mental health

- Pediatric care(including vision and dental coverage)

- Lab tests(including 100% coverage of tests used for diagnosing conditions)

- Outpatient care

- Prescription drugs

- Hospital stays

- Emergency room visits

The ACA saw the introduction of new taxes to pay for the benefits and the provisions. These are charged to insurance companies and passed down to customers. Americans also faced a tax of 2.6% if they did not have health coverage by January 31, 2016.

Affordable Care Act Small Business Implications

The ACA will have implications for many everyday Americans. Coverage may change, as will premiums. However, this legislation affects not only individual consumers. Companies and businesses offering health care to employees will also be affected. For example, companies are now eligible for tax breaks so they can offer health care coverage for their workers.

Small businesses, especially, can get tax breaks and credits up to 50% of their insurance costs and are able to purchase their own health coverage for workers. Small businesses, defined as companies with no more than 25 employees, also qualify for Federal financial assistance if they provide health coverage for their employees who are early retirees (retirees between the ages of 55 and 64).

Employer Health Care Considerations

Employers with at least 100 employees are required to offer health insurance to those employees by 2015. Businesses with 50-99 workers needed to offer health care by January 2016 to stay compliant. Those in violation of this part of the ACA face a tax increase of $2,000 per employee, with the first 30 employees exempt. Businesses with fewer than 50 employees can search for health coverage through an online exchange or can secure coverage through brokers and insurance companies.

One of the things employers will need to consider first is whether they are required to provide coverage. If you have more than 50 full-time equivalent workers, you may need to provide health insurance to employees. Many businesses are concerned about whether they will need to provide this additional benefit, but 96% of businesses in America are exempt from this requirement. However, smaller businesses who want to offer health insurance can now do so more affordably than before.

Initially, there have been some concerns about health coverage reform under the ACA. Some individuals saw health premiums increase, for example, and not everyone qualified for the assistance and breaks to offset these costs. Many also worried that the increased cost of offering benefits would negatively affect their businesses. In addition, some workers were affected when employers reduced full-time hours to part-time hours before the ACA came into effect to avoid having to pay benefits.

In reality, small businesses and self-employed individuals stand to gain the most from the ACA, with more affordable coverage for workers and the option of getting this benefit for themselves or employees. Larger businesses with many low-wage full-time equivalent workers, however, may see taxes and costs increase. There has been some debate about whether this may increase consumer costs as larger companies pass increased costs down to customers.

Understanding the ACA Employer Mandate and How it Affects Businesses

The biggest change for many companies will be the introduction of health coverage for workers. More companies may need to start offering health care to employees. For example, the Affordable Care Act Employer Mandate requires all businesses with more than 50 full-time equivalent workers to provide health insurance to full-time employees. Businesses not compliant with this rule need to pay a Shared Responsibility Payment. Companies who have at least 50 full-time equivalent workers need to provide at least "bronze" level plans through the health insurance exchange to full-time employees or must offer employee only coverage over 9.5% of family income.

Companies who have over 100 full-time equivalent workers need to offer health coverage for 95% of their full-time employees. Both small and large organizations who are starting to offer health coverage to workers may qualify for transition relief through the IRS, to make the process easier and more affordable.

Some companies (and workers) may also face increased taxes. Specifically, companies making profits in excess of $250,000 will need to pay 0.9% more in Medicare part A tax. Employees with a household income of $250,000 or more will need to contribute as well. For these employees, Medicare tax will be split between the employer and employee, amounting to 0.45% each.

Companies may need to share more information with workers. Specifically, companies with more than 50 full-time equivalent workers will need to inform their employees about the exchange or marketplace in their state. These companies will need to offer a form that lists a Summary of Benefits and Coverage to employees and will have to offer new employees health insurance benefits within no more than 90 day of hiring.

Businesses will also have to keep more documentation to stay compliant with the ACA. However, the ACA is still changing and shifting, so requirements will inevitably change as well. Compliance requirements with the ACA necessitate that companies to maintain careful documentation about employee hours and health coverage. In addition, the government may require notifications about health coverage offered.

The compliance requirements can also mean audits. In Pennsylvania alone, Department of Labor audits increased 300% year-over-year. Companies who are not compliant and subsequently audited face expensive fines. All audited businesses will face the time-consuming process involved. Small businesses can be especially affected, since they may not have a legal team to guide them through the audit procedure and the regulations involved.

Employer Health Care Costs and Your Small Business

When President Barack Obama first introduced the ACA, many were concerned about the impact of the legislation on small business. After all, about 90% of businesses in America are small companies with less than 20 full-time workers. In fact, only 4% of companies in this country have more than 50 full-time employees. With so many small businesses, critics were concerned that new health coverage requirements would prove expensive for these smaller organizations.

One of the concerns, especially, was the increasing cost of health insurance premiums for businesses. In 2014, for example, premiums saw a 20% jump and may increase another 8% in 2016. For small businesses, these cost increases were a concern because the expenses may need to be passed on to the employees or to customers.

However, the ACA has provided a number of tax breaks and benefits to make health coverage affordable for small businesses. The act created SHOP (the Small Business Health Options Program) to help small businesses with no more than 100 full-time workers find group health coverage. Businesses can also use SHOP to apply for tax breaks.

Businesses with average wages under $50,000 and with fewer than 25 full-time equivalent workers can get tax breaks to make health coverage affordable. These credits are retroactive, meaning businesses can claim credits for years from 2010 or later.

Many small businesses in this country are in fact self-employed people. Before ACA, self-employed people struggled to get health coverage. In many cases, this did not qualify for group coverage and their monthly premiums were very high compared with other workers.

Under the ACA, self-employed individuals enjoy a number of benefits to make health coverage more affordable. If you report a profit as a self-employed person, you can deduct the total cost of premiums for dental and medical costs, as well as all added dental and medical expenses from your gross income when you file your tax return. You may also qualify for cost assistance.

In short, the ACA makes it mandatory for many businesses to offer insurance. However, it also makes it easier to find coverage through SHOP and makes health insurance more affordable through insurance reform and tax breaks.

Full Time Equivalency and the ACA

If you have 50 or more employees as a business, you need to think about full time equivalency when considering compliance. Under the ACA, full-time equivalency (rather than full-time) is considered to prevent employers from just hiring part-time workers to avoid offering benefits.

Under full time equivalency definitions, the number of full-time equivalent employees is defined as the number of full-time workers plus part-time hours divided by 30. A full-time employee is a worker who has worked 30 hours a week or more than 130 hours per month over a 120-day period.

Contractors, seasonal workers and some other employees are not used when determining full-time equivalency. The ACA website has a calculator to help businesses determine how many full-time equivalent employees they have. You can also calculate the totals yourself by differentiating between full-time and part-time employees using Average Weekly Employee hours.

Staying Compliant

Staying compliant with ACA is crucial if you want to avoid higher taxes and costs. In addition, if you choose to take advantage of the small business tax breaks and credits to offer health coverage to your workers to attract qualified candidates, you will need to stay compliant to ensure you apply for the correct breaks and credits.

To do both, you need to see where your employee's time goes and who works when. How many of your employees are working full-time hours this month? How many are earning above specific benchmarks? Compliance with the ACA is not all you need to be concerned with. The IRS needs accurate records each year and in December 2016 a new overtime law will affect employees earning under $47,476 per year.

Laws change all the time and the ACA is not immune. Are you ready? To make bookkeeping and compliance simpler, many organizations are turning to Orbital Shift online workforce management software. Orbital Shift can help you keep track of how many employees are working specific numbers of hours (and when).

When it's time to apply for health care benefits for your workers, you will have the accurate information you need about full-time employees, part-time hours worked and everything you need to calculate full time equivalency and other issues. Remember: these issues can affect your tax credits and the health insurance you need for your employees, so accuracy is paramount.

Keep in mind, too, that to stay compliant with the ACA you will need to keep careful records providing which employees are full-time and part-time. You may have to report to the government about which employees have received coverage. Keeping accurate time documentation is very important to not only stay compliant but also to prove compliance if any problem arises.

Orbital Shift online workforce management software can do more than keep you compliant. It can also help you handle scheduling issues and manage time and costs. With Orbital Shift software, it's easy to schedule employees, keep track of work hours and to ensure you spend less trying to manage time sheets. Try a free trial today to find out just how much Orbital Shift can help you keep track of your business.